The Sunday Signal: The Fall of Professions, the Failure of Banks, the Fury of Bethpage

Essential insights on law, money and sport Issue #24 – Sunday 28 September 2025

The Bottom Line Up Front

Professions once seen as untouchable are crumbling under the weight of technology. The great pyramids of law, audit and consulting were built on selling time, not outcomes. Now AI is tearing through the foundation. Banks, once impregnable, are already being displaced by fintechs that move money at the speed of thought. And golf, of all games, has shown how even the most civilised of sports can descend into a bear pit when tradition is abandoned.

This week we look at three areas that reveal the same truth: the old order has mistaken habit for permanence.

The End of the Rule Book Racket

Apologies to my friends in law, audit and consulting. But the truth is unavoidable. Large parts of these professions are process. And process is what machines do better than people.

Conveyancing is the most obvious example. It should be digital, instant and low cost. Instead it is slow, paper-bound and extortionate. Buying or selling a home in Britain can take months and cost thousands. The public is not paying for wisdom. They are paying for inertia.

Litigation is worse. The tennis match of letters has been one of the great money-spinners of the legal trade. Letter. Reply. Letter. Reply. Each volley billed at thousands. The client watches helplessly as costs soar. Both sets of lawyers eat well. The dispute grinds on. I know people who have cut this racket down to nothing by using AI. Drafting, reviewing, responding — all handled in seconds. The bill never starts.

Audit firms have also quietly embraced AI. They boast of efficiency, of automation, of productivity gains. Yet their fees never seem to fall. The savings are not shared with clients. They are banked as higher profit. The public purse and shareholders pay the same for work that machines now complete.

Consulting is now being hollowed out. For decades the model was clear. Partners sell relationships. Armies of juniors do the legwork: analysing data, building slides, writing reports. It was always a pyramid. The weight rested on the backs of twenty-five-year-olds working into the night. That base is vanishing. Machines now handle the grunt work in seconds. McKinsey has admitted the threat is “existential.” By some estimates, forty per cent of its hours could be automated this year. Rivals are no different. BCG, Deloitte, and KPMG — all are being eaten from within.

The irony is stark. These firms once sold themselves as navigators of disruption. They are now being disrupted in exactly the way they once described.

The pattern is unmistakable. Professions built on repetition are finished. Advice that is rare, creative and accountable will still command a premium. But armies of juniors working on data and process are already redundant.

The lesson is brutal. If you sell time, you are running out of it. If you sell judgment, your stock has never been higher.

Banking Is Necessary. Banks Are Not.

My weekly column in the Yorkshire Post

Bill Gates said it three decades ago. Banking is necessary. Banks are not. It sounded provocative at the time. Today it reads like prophecy.

I almost joined a bank as a graduate in 1988. Within minutes I knew it was a mistake. Stale corridors, bureaucratic rituals, a culture that felt more like a museum than a business. I walked away.

Decades later, when I returned to Britain, I tried again as a customer. It was worse. Endless forms for a personal account. A clunky plastic login token for business banking. It was absurd. In an age where my phone could already move money globally, this was not tradition. It was incompetence dressed as permanence.

The truth is that the last genuine innovation from banks was the cash machine in the 1960s. Everything else since has been patchwork. Faster payments. Contactless. Mobile apps. Each a thin veneer on the same rotting core. Banks built marble lobbies and regulatory moats and mistook them for relevance.

Meanwhile, the future arrived. Quietly at first. Now unmistakably.

At Yorkshire AI Labs we run our portfolio companies entirely through Revolut and Wise. Six-figure sums move in seconds. Exchange rates are transparent. Security sits in my pocket. The same transaction through a high street bank would take days and cost thousands in hidden fees.

This is not marginal. Revolut now serves more than 40 million customers. Wise processes billions every month. They are not the upstarts any longer. They are the system. Legacy banks are the sideshow.

The unbundling is complete. Current accounts here. Payments there. Foreign exchange somewhere else. The great universal bank has been dismantled in plain sight.

The implications for Britain are enormous. Banks once powered the economy. Now they slow it down. Fintechs are sprinting ahead. Banks are lobbying regulators to slow them down. It is defensive and pathetic. Customers have already made their choice.

Banking will survive because money has to move. But banks in their current form are finished. They have lost their customers, their purpose, and their monopoly. All they have left is habit. And habit is the weakest moat of all.

Read My Column In The Yorkshire Post

The Ryder Cup Shame

Hugh McIlvanney once called sport “a magnificent irrelevance.” He meant that it matters precisely because it does not matter. Which is why the Ryder Cup at Bethpage mattered.

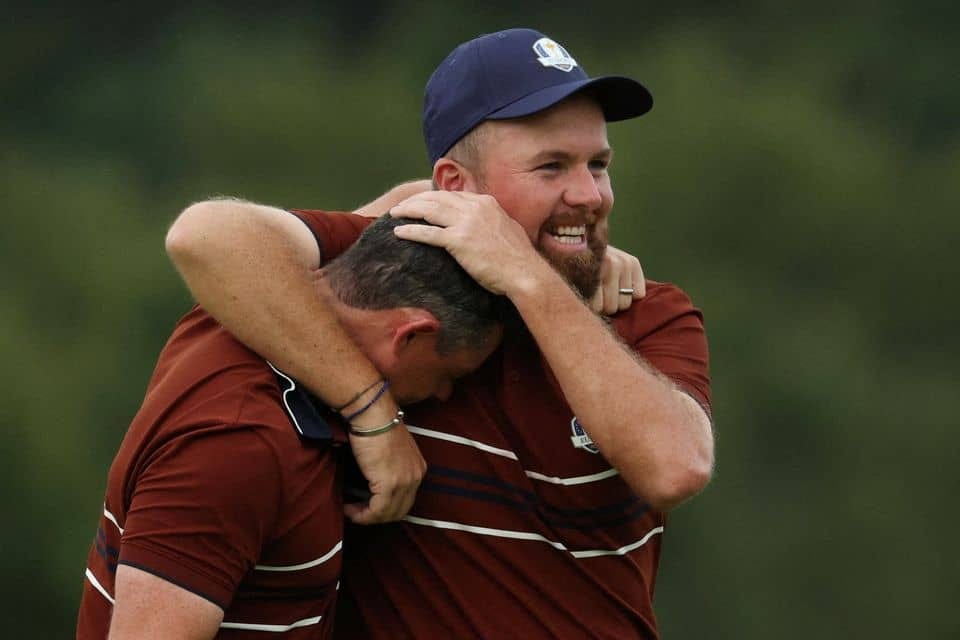

Luke Donald knew what was coming. He gave his European team VR headsets to simulate American abuse. Rory McIlroy laughed at the gimmick. He was right. Nothing could prepare them for the reality.

From the first tee the bile poured down. By Saturday it had crossed the line. Wives and families abused. Players jeered over their looks and their heritage. McIlroy refused to continue until hecklers were removed. Security rushed in. Police dogs patrolled the ropes. It was golf as theatre of hate.

This is golf. A game of civility, built on silence, honesty and respect. Silence before a shot is not courtesy. It is the essence of the game. To trample that is to trample golf itself.

The European players held firm. McIlroy drained a putt and screamed back at the mob. Lowry dug deep and won in spite of the abuse. They carried the day. But they paid the price. McIlroy admitted he was drained. Families stayed away. Even some Americans admitted they were ashamed.

The Ryder Cup is supposed to show the best of golf. Instead it showed its fragility. If golf, of all sports, cannot protect its own soul, then what chance for the rest?

Europe will win the trophy. But America lost something more valuable. Hugh McIlvanney, who understood better than anyone that sport matters only when it lifts us, would have called the behaviour of the Bethpage crowd what it was: a disgrace.

(Couldn’t resist - that was taken at the Ryder Cup in Rome 2023)

🚀 Final Thought

When the Old Order Falls

Professions collapse slowly, then all at once. The lawyers, auditors and consultants who sell hours are about to discover that the clock is no longer their ally. The banks that mistook marble for permanence are already being bypassed by software. Even golf, once the most civilised of sports, risks losing its character when it mistakes noise for passion.

Change always feels impossible until suddenly it feels inevitable. That is the moment we are in now. Professions, institutions and even games are being tested. Most will not survive in their current form. The question is no longer whether the old order will fall. It is how quickly, and who is ready to build what comes next.

Until next Sunday,

David

David Richards MBE is a technology entrepreneur, educator, and commentator. The Sunday Signal offers weekly insights at the intersection of technology, society, and human potential.

© 2025 David Richards. All rights reserved.