The Sunday Signal: When the North Walked Into the City

Essential insights on belief, capital and transformation. Issue #31 – Friday 14 November 2025

The Bottom Line Up Front

Belief begins with what you can see.

I learned that lesson as a twenty-two-year-old on a train to Chertsey, when a conversation about Sheffield football led to my first job in tech. I watched a small company go public and realised that an IPO is not magic. It is process, discipline and courage. Once you have seen it, you know it can be done.

This week’s Sunday Signal is about visibility. The moment a founder sees the floor of the London Stock Exchange. The moment an entrepreneur realises that public markets are not off limits. The moment a world discovering AI finally understands how fast the next transformation is arriving.

The first article expands on my Yorkshire Post column about The Digital Forge opening the LSE with South Yorkshire’s brightest founders. The second explains why the public markets, AQUIS, AIM and the LSE (main market), can be the best route to growth capital in Britain. The third examines McKinsey’s State of AI in 2025 and what it reveals about the next phase of intelligent transformation.

Belief begins with vision. Seeing it changes everything.

Seeing It Changes Everything

From my Weekly Yorkshire Post Column

When The Digital Forge led a trade mission from South Yorkshire to open the London Stock Exchange, it was not a photo opportunity. It was a signal.

The room filled before dawn. Founders from across our ecosystem stood on the balcony above the trading floor. Below them, the market screens flickered to life. In that moment, they were not visitors from the North. They were participants in the capital of capital.

A Visible Path

I learned the power of visibility years earlier. At Druid Systems, my first employer, I watched ordinary people take an extraordinary step. They listed their company. No mystique, just competence and nerve. When I later took my own company public, it felt like following a well-worn map. That is what we wanted for the founders who joined the mission. Replace abstraction with experience.

What We Showed London

South Yorkshire’s Mayor, Oliver Coppard, rang the opening bell and set out the case for our region. He highlighted that our tech startups are now worth £3.3 billion, that Sheffield is the fastest growing big city in the country over the last decade, and that Rotherham has seen some of the fastest productivity gains since 2004. He pointed to the world’s first Advanced Manufacturing Innovation District and our position as one of only five UK regions with a Defence Growth Deal.

This mission was organised by Yorkshire AI Labs and Digital Forge CIC in partnership with the South Yorkshire Mayoral Combined Authority and Oberon Investments. It brought investors, bankers and public markets specialists into the same rooms as our founders. The goal was simple. Connect ambition to capital.

Who Took the Stage

The presenting companies at the LSE were Exciting Instruments, Bow, FourJaw, and DigitalCNC. These firms embody our edge in advanced manufacturing and digital technology. They are modern proof that South Yorkshire is not a museum of industry. It is a workshop for the next era.

Bod Buckby at the London Stock Exchange said the event showcased the region’s ability to lead in advanced manufacturing and digital technology. Oberon’s Adam Pollock noted how rare it is to see this concentration of engineering talent and scientific innovation in one place. Both are right. Our task now is to make this concentration visible to capital every week.

Belief as Infrastructure

The founders returned home different. They had shaken hands with fund managers, walked the marble corridors, and seen the bell that marks a beginning, not an end. For the City, it was a reminder that the next generation of listed companies may already be forming in our labs and workshops. For the region, it was a declaration that aspiration is not enough. We must build visibility into our economic infrastructure.

Seeing it changes everything. It replaces myth with method, and distance with intent.

The Case for Going Public

For too long, British entrepreneurs have believed that venture capital is the only way to grow. It is not. The public markets are an equally powerful path to scale.

The Gap We Have To Close

Late stage is where British companies most often stall. The pipeline narrows just as firms need fuel to expand internationally, industrialise production and build distribution. That is when founders are pushed to sell early, list abroad, or surrender control to foreign buyers. DeepMind and ARM show that the world recognises our talent. The question is whether we will fund it at home.

Why Public Markets Work

Listing on AQUIS, AIM or the London Stock Exchange brings three things that change outcomes.

Access to scale capital. Primary raises and follow-ons give you a funding runway that is repeatable when you deliver.

Liquidity with discipline. Public investors back numbers, governance and clarity. They reward transparent operators who hit their plan.

Independence. A founder-led business with a strong board and clean financials can move faster than a late VC process. The best founders already run their companies like public entities before they file the paperwork.

This is not starry-eyed. It is a choice about operating model. Public markets force you to build dashboards that the whole world can read. Cash first. Plain English over spin. Weekly truth.

A Simple National Fix

We do not need slogans. We need a structural shift that thickens the growth stage. That means more domestic, patient capital pointed at British companies that are scaling. A modest increase in UK institutional allocation to listed growth and small-cap would change the market’s depth, normalise B and C-stage funding, and make London the natural venue for ambitious founders.

Going public is not an act of desperation. It is an act of belief. In your numbers. In your team. In Britain.

The State of AI in 2025

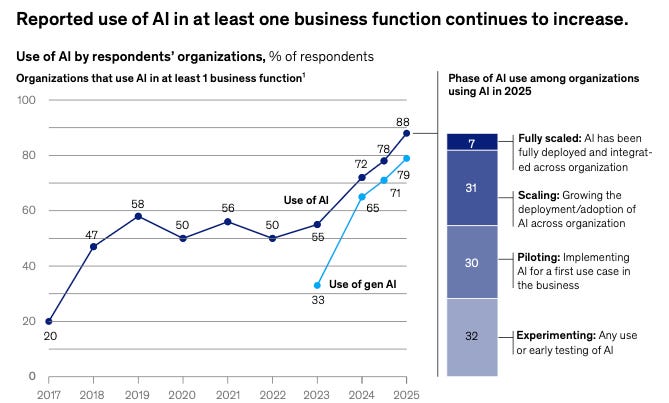

Artificial intelligence has moved from novelty to necessity. The latest McKinsey Global Survey on AI finds that almost all organisations now use AI in at least one function, yet most are still short of enterprise scale. Reported regular use is widespread, but only about a third have moved beyond pilots into scaling across the business.

The Rise of Agents

This year’s defining shift is the rise of AI agents. These are systems built on foundation models that can plan and execute multi-step workflows in the real world. McKinsey reports that 62 per cent of organisations are experimenting with agents, while 23 per cent are already scaling at least one agentic system somewhere in the enterprise. Adoption is strongest in technology, media and telecommunications, and healthcare.

In practice, that means service desks that triage and resolve, knowledge engines that synthesise research, and supply chains that replan in real time. Agents are not chatboxes. They are digital colleagues.

What The Winners Do Differently

McKinsey highlights a small group of AI high performers. They attribute meaningful EBIT to AI and report significant value from its use. They share three habits. They redesign workflows, not just tasks. They invest at a higher rate, with more than 20 percent of digital budgets going to AI. Their senior leaders own the change and model adoption.

These firms also keep humans in the loop. They define where model outputs require validation. They build technology and data infrastructure ready for scale. They track adoption with product-like discipline. This is not about tools. It is about management.

From Efficiency To Imagination

Efficiency is no longer the prize. Growth and innovation are. The high performers use AI to create new products, rewire customer journeys and accelerate learning cycles. They treat AI as an enabler of business model change. The technology is ready. What is missing in most places is conviction.

Final Thought

Progress begins the moment we stop staring at closed doors and start walking through them.

In business, in capital and in technology, visibility creates conviction. The founders who stood on the LSE balcony saw not a symbol but a system. The investors who watched them saw a region refusing to wait for permission. The executives studying the State of AI report see the same truth. Opportunity belongs to those who act before certainty arrives.

Britain’s problem is not talent. It is belief. We have the ideas, the engineers and the appetite. Too often we look to someone else for validation. The Americans do not. They see risk as the price of greatness. We treat it as a verdict on character. That is why their startups raise more, their pension funds back their own, and their founders stay until the job is finished.

The future will not be kind to hesitation. Capital flows where confidence lives. Innovation follows capital. Regions that hesitate become suppliers to those that do not. The question for Britain is whether we want to build the next generation of industries or simply read about them after they float in New York.

The Digital Forge mission showed what happens when you bring ambition and access together. When northern founders saw the opening bell ring, the divide between Sheffield and the City disappeared. You cannot unsee that. Once you have watched an ordinary person list a company, the idea of impossibility dissolves.

AI is forcing the same reckoning on a global scale. The companies that treat it as an experiment will fade. The ones that rebuild themselves around intelligence will define the next economy. We are entering a decade that will reward clarity, courage and speed. Those qualities cannot be outsourced.

Seeing it changes everything. It changes how we think, how we build and how we fund. Most of all, it changes who we believe ourselves to be. The future does not belong to the biggest or the loudest. It belongs to those who can see what is possible before others do, and act on it.

Read The Sunday Signal first every Friday on Substack.

Public release follows on Sunday.