The Sunday Signal: Secrecy and the British Class System

Essential Insights on Tech’s Impact, Leadership Lessons, and Navigating Human Potential Issue #12 – Sunday 6 July 2025

⏱️ 7 min read

The Bottom Line Up Front

Britain operates on two levels: the visible meritocracy we celebrate in public discourse, and the invisible architecture of exclusion that actually determines opportunity. From Soviet spies protected by class privilege to financial jargon designed to exclude outsiders, this hidden system constrains Britain's potential at precisely the moment when global competition demands we harness every available talent. Understanding these buried dynamics isn't academic curiosity. It's essential for national competitiveness.

The Protective Shield of Privilege

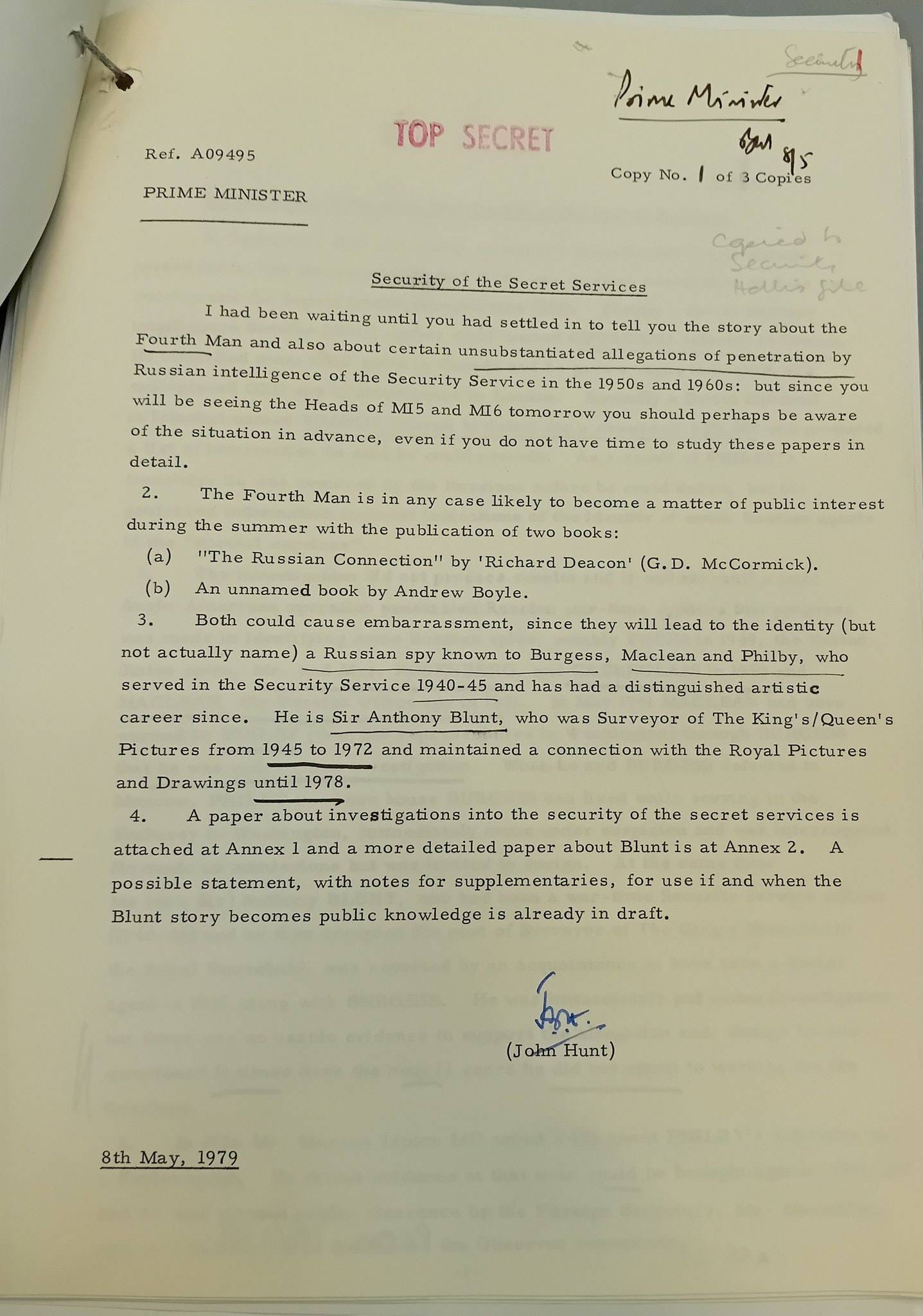

In May 1979, Margaret Thatcher received a top secret memo revealing something that would have shocked the British public: Sir Anthony Blunt, Surveyor of the Queen's Pictures and respected art historian, was a Soviet spy. The revelation wasn't surprising because of his betrayal, but because of how long his aristocratic status had shielded him from scrutiny.

Blunt's case illuminates something profound about how Britain actually works. His privileged social position didn't just delay his exposure. It fundamentally altered how the intelligence services approached investigating him. Class loyalty trumped national security concerns for decades. The same protective instincts that shielded Blunt extended to Guy Burgess, Donald Maclean, and Kim Philby, revealing a broader network where establishment credentials provided operational security more effective than any tradecraft.

This wasn't simply historical curiosity. Thatcher herself faced constraints in exposing these betrayals, navigating sensitivities within Britain's establishment that could constrain even prime ministers. The affair revealed how entrenched class loyalties create parallel systems of accountability, or rather, exemption from accountability.

These dynamics didn't disappear with the Cold War. They evolved, becoming more sophisticated and harder to detect, but no less consequential for Britain's ability to compete in a global economy that increasingly rewards merit over pedigree.

The Language of Exclusion

Adapted from my latest Yorkshire Post column.

Today's equivalent operates in plain sight within the City of London, where coded language serves the same exclusionary function as Blunt's class credentials. During my years navigating financial markets as a company leader, I discovered that statements like "trading in line with expectations" actually signal underperformance against forecasts. "Strategic review underway" typically means desperately seeking buyers, whilst "facing headwinds" covers everything from market volatility to internal chaos.

Before my direct involvement in these circles, I took such language at face value. Only later did I recognise this communication system as deliberately designed to manage perceptions whilst maintaining exclusivity. The City's dialect ensures that only insiders truly understand what's being communicated, creating barriers as effective as any physical gatekeeping.

This linguistic exclusion serves multiple functions: it protects established interests from external scrutiny, maintains the mystique essential to the City's global reputation, and ensures that outsiders remain dependent on intermediaries who speak the language fluently. The system perpetuates itself by making access contingent on cultural fluency rather than analytical capability.

Most critically, this approach shapes how Britain allocates capital and opportunity. When financial communication deliberately obscures rather than clarifies, it creates systematic disadvantages for entrepreneurs and businesses lacking insider access to translation. In a global economy where speed and transparency increasingly determine competitive advantage, such opacity becomes a strategic liability.

The Meritocracy Illusion

Adapted from my latest Yorkshire Post column.

These exclusionary mechanisms extend far beyond finance into the broader question of how Britain identifies and develops talent. The persistent weight placed on educational pedigree and social provenance represents a fundamental misallocation of human resources at a time when technological disruption demands adaptive capability over inherited advantage.

The accompanying photograph of the Bullingdon Club provides stark visual evidence of this dynamic. Three figures in that image, David Cameron, Boris Johnson, and George Osborne, subsequently became Prime Minister or Chancellor. This isn't coincidence but pattern. The exclusive Oxford dining club, notorious for its wealthy membership and destructive behaviour, functioned as a pathway to power that bypassed traditional merit-based selection entirely.

My experience in Silicon Valley provided stark contrast to this British reality. Colleagues ranged from university dropouts to PhD holders, with ideas and execution determining influence rather than background or accent. This wasn't abstract idealism but practical necessity. In rapidly evolving technological markets, clinging to traditional hierarchies meant missing innovations emerging from unexpected sources.

The seemingly innocuous question "What school did you attend?" continues functioning as a subtle but effective gatekeeper, determining class alignment and social acceptance in ways that constrain opportunity allocation. This creates systematic inefficiencies where brilliant individuals in Bradford or Barnsley face barriers unrelated to their actual capabilities or potential contributions.

These inefficiencies compound over time. When promotion, investment, and partnership decisions incorporate class-based signals alongside merit-based criteria, the cumulative effect creates divergent pathways that amplify initial advantages or disadvantages. Talent that could drive innovation instead gets filtered out through processes designed to maintain existing hierarchies.

The Innovation Penalty

The intersection of these dynamics creates what I call the "innovation penalty". Britain's most transformative potential gets systematically excluded from decision-making processes. Whilst other economies increasingly reward disruption and unconventional thinking, Britain's hidden architecture of exclusion ensures that transformative ideas often emerge from predictable sources with appropriate credentials.

This represents more than missed opportunities; it constitutes strategic vulnerability. In technological competition with economies that more effectively harness distributed talent, maintaining systems designed to protect established interests becomes economically counterproductive. China's rise partly reflects willingness to promote based on performance rather than pedigree. America's technological dominance stems from constantly refreshing leadership with outsiders who lack investment in existing systems.

Britain's challenge isn't lack of talent. It's systematic underutilisation of available capability. The same mechanisms that once provided stability in slower-moving economies now create rigidity in contexts demanding rapid adaptation. Educational excellence gets trapped behind class barriers. Entrepreneurial energy encounters subtle but persistent exclusion. Financial resources flow through networks prioritising connection over innovation.

🚀 Final Thought

Unlocking Britain’s True Potential

Addressing these dynamics requires more than acknowledging their existence. It demands systematic changes in how Britain identifies opportunity, allocates resources, and measures success. This isn't about dismantling tradition but about separating valuable cultural elements from counterproductive exclusionary practices.

Practical steps include making selection criteria explicit rather than implicit, measuring outcomes rather than inputs, and creating pathways that bypass traditional gatekeepers. Technology companies succeeding globally demonstrate that diverse teams outperform homogeneous ones, not through ideological commitment but practical experience. Britain's future competitiveness depends on applying these lessons systematically across sectors.

The goal isn't eliminating hierarchy but ensuring that hierarchies reflect contribution rather than inheritance. This requires confronting uncomfortable realities about how current systems actually operate versus how they're supposed to operate. Change becomes possible only when these hidden dynamics become visible and their costs become undeniable.

Britain possesses extraordinary reserves of talent, creativity, and entrepreneurial energy. The question is whether existing systems will continue constraining these resources or evolve to harness them effectively. In a global economy increasingly defined by innovation and adaptation, this choice will determine whether Britain leads or follows in the decades ahead.

Until next Sunday,

David

David Richards MBE is a technology entrepreneur, educator, and commentator. The Sunday Signal offers weekly insights at the intersection of technology, society, and human potential.

© 2025 David Richards. All rights reserved.