The Sunday Signal: Investing in Britain's Industrial Renaissance

Essential Insights on Tech’s Impact, Leadership Lessons, and Navigating Human Potential Issue #14 – Sunday 20 July 2025

⏱️ 10 min read

The Bottom Line Up Front

Britain stands at a pivotal moment. Strategic investment in domestic industries, leveraging advanced manufacturing and practical AI innovation, can revitalise our economy and secure our future. However, our pensions continue to flow overseas, depriving British innovation of the essential capital it needs. This is not an innovation issue; it is fundamentally an investment issue, and it is solvable.

Britain Must Start Making Again

This week's Digital Forge Summit in Sheffield highlighted the same message as March’s event: Britain must begin making again. Sheffield Forgemasters is now undergoing a £1.3 billion recapitalisation programme from the Ministry of Defence. This substantial investment ensures the UK retains sovereign capacity to produce parts for nuclear submarines and other defence systems. The upgraded facilities, featuring 15 advanced vertical turning lathes and modern forging lines, will foster highly skilled jobs, expand apprenticeships, and boost the regional economy.

Forged Solutions, also present at the summit, provides precision-engineered aerospace components found in almost every commercial aircraft in the sky. These firms exemplify the concrete outcomes possible with targeted industrial investment.

Richard Caborn went further, calling for Sheffield’s Old Davy Markham site to become the UK’s primary base for Small Modular Reactor production. Domestically built SMRs would improve our energy security, generate thousands of jobs, and drive regional growth.

At the same event, Kate Josephs announced Walsin Lihwa’s investment in Special Melted Products Ltd in Sheffield, securing hundreds more high-skilled manufacturing roles. That marks yet another vote of confidence from foreign investors in Britain’s industrial potential.

Keith Ridgway, speaking at the March Digital Forge event, sounded a warning by visiting Pen y Cymoedd Wind Farm, the largest in England and Wales. Despite powering 15 per cent of Welsh homes at a cost of £400 million, every turbine component was made overseas. The only UK-made items were the coffee and sandwiches served on site. Ridgway also noted that we invented a method for flat-packing trains from Japan and assembling them here. These stark examples show the glaring manufacturing gaps we must fix.

British Pensions: Financing Decline or Growth?

Adapted from my latest Yorkshire Post column.

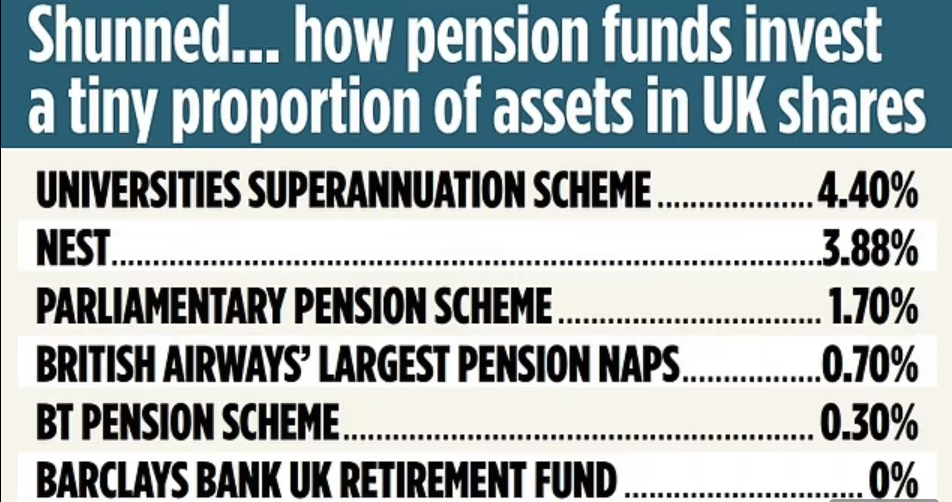

In my recent Yorkshire Post column, I challenged Britain's pension investment practices. UK pension funds control approximately £3 trillion yet allocate a mere 4.4% domestically, while more than £2 trillion flows into US equities. This disproportionate overseas investment means British pensions effectively subsidise American innovation, leaving our homegrown companies starved of growth capital.

The sale of DeepMind to Google for £400 million in 2014 illustrates this issue vividly. Today, DeepMind is valued between £20 billion and £30 billion, yet the benefits primarily accrue overseas, despite initial funding indirectly originating from UK pension holders. This scenario repeats across many promising British companies, highlighting a chronic deficiency in Series B financing domestically, driving founders to prematurely sell their companies abroad.

Adam Pollock of Oberon Capital proposes an evergreen £3 billion fund dedicated to the crippled UK small‑cap market (companies with market caps below £250 million). AIM, our junior growth market, has shrunk from a peak of about 1 694 listings in 2007 to just 663 by March 2025, a drop of more than 60 per cent. In the last year alone, AIM lost 61 listings, a 23‑year low of 679 in early 2025. The contraction undermines liquidity and investor confidence, making it increasingly difficult for SMEs to raise Series B funding in Britain.

Pollock’s proposal offers a focused remedy: by investing pension capital into this neglected segment, the fund would provide stable, long‑term growth financing for SMEs. This would reduce the number of GP-led sales or capitulations and help reverse the chronic underfunding of Britain’s innovation ecosystem.

Yorkshire’s Practical AI Innovation: A Blueprint for Investment

In Parliament this week, I had the privilege of briefing the AI Committee on real-world outcomes from practical AI adoption supported by Yorkshire AI Labs LLP. These MPs, tasked with shaping national AI policy, saw firsthand how AI is already delivering tangible benefits to local economies and industries.

PureTec uses AI to automate the production of sustainable clear aligners, significantly reducing orthodontic costs and making care affordable for everyone. IntelliAM AI PLC is delivering double-digit productivity improvements to multinational FMCG companies, enhancing competitiveness and profitability. DigitalCNC is transforming manufacturing productivity by using AI to accurately predict machine behaviour before it cuts metal.

However, these successes represent only a fraction of the potential that remains constrained by insufficient growth-stage funding. MPs were receptive to this crucial message, recognising that practical AI innovation urgently needs targeted investment if Britain is to maintain a competitive global position.

How many more DeepMinds are waiting to flourish across Britain? The UK has innovation in abundance; our challenge remains domestic investment.

🚀 Final Thought

An Investment Issue, Not an Innovation Issue

Britain’s industrial renaissance, powered by Sheffield Forgemasters, Forged Solutions, AI innovators, and forward-thinking investors, is achievable immediately. Yet pension capital continues to flow overseas, leaving domestic innovation underfunded.

We do not need to discover more innovators; we need to invest in them. Redirecting just a modest proportion of UK pension assets could trigger exponential growth, strengthen economic sovereignty, and deliver long term prosperity.

The issue is clear. So is the solution. Now is the time to invest decisively in Britain's future.

Until next Sunday,

David

David Richards MBE is a technology entrepreneur, educator, and commentator. The Sunday Signal offers weekly insights at the intersection of technology, society, and human potential.

© 2025 David Richards. All rights reserved.