The Sunday Signal: Britain Invents, America Invests

Essential insights on capital, cities, and the democratisation of startups Issue #23 – Sunday 21 September 2025

The Bottom Line Up Front

This week, I want to focus on the way Britain is giving away its own future. We fund world-class research at universities like Bristol and Imperial. We train the engineers and scientists. We pay for the breakthroughs. Then our pension funds refuse to back the companies that grow from that research. American investors step in, and the jobs, the wealth and the advantage go abroad. PsiQuantum is the latest case study, but it will not be the last.

From there, I turn to San Francisco. In recent years, it became a global symbol of decline, with homelessness, fentanyl and crime dominating the headlines. But the city is starting to recover. Decline is not destiny. Even places that fall far can climb again with leadership and grit.

Finally, I look at how AI has democratised entrepreneurship. What once required millions of pounds and teams of specialists now needs little more than a laptop and free software. The barriers that once locked out new founders are crumbling. The democratisation of entrepreneurship is here.

Britain Invents, America Invests: Why Our Pensions Fuel American Growth, Not British Jobs

On Monday, I spoke at the Social Mobility Commission Symposium in Manchester with Rob Wilson. The theme of the day was how we create opportunity, widen access and drive innovation. My point was blunt. Until Britain takes back control of its own capital, we will continue to invent for others while they take the rewards.

Our pension funds control around £3 trillion. Yet only 4.4 per cent of that is invested in UK companies. More than £2 trillion flows overseas, most of it into American equities. In practice this means British workers pay into pension schemes that fund America’s growth while our own firms remain starved of backing.

Fund managers like to claim that investing in growth companies here is too risky. I disagree. The real risk is hollowing out our economy, exporting jobs, and surrendering the future. The real recklessness is refusing to back our own talent while underwriting the rise of America’s next generation of giants.

PsiQuantum proves the point.

The company was born out of British taxpayer funding. Imperial College London. The University of Bristol. Laboratories, grants, professors, PhDs. All paid for by the public purse. Out of this environment came the breakthrough: a path to building a million-qubit fault-tolerant quantum computer. A machine that could transform everything from drug discovery to finance to defence.

Last week PsiQuantum raised one billion dollars. Its valuation is now seven billion. Its backers include BlackRock, Temasek, Baillie Gifford and Nvidia. Its headquarters are in California. Its first machines will be built in Chicago and Brisbane.

The research was British. The researchers were trained here. The early funding was British. Yet the jobs will be American. The tax receipts will be American. The wealth will be American.

This is not prudence. It is negligence. British taxpayers are paying twice. First we fund the research that produces the breakthroughs. Then our pensions fund the American companies that commercialise them. Ideas here. Wealth there.

Think about the scale of what is being lost. Quantum computing is expected to underpin trillion-dollar industries. If PsiQuantum succeeds, it could generate tens of billions in revenue and tens of thousands of high-value jobs. If it had stayed here, the economic impact would have been enormous. Instead, it will happen elsewhere because our capital markets were too timid to act.

This is not a one-off. DeepMind was sold to Google. ARM was sold overseas. Dozens of biotech firms have gone the same way. Each time the excuse is the same: pension funds cannot take the risk. Each time the result is the same: Britain invents, America invests.

If just five per cent more of pension fund capital were invested at home, the change would be transformative. We could scale companies here. We could create jobs across the regions. We could raise tax receipts and improve social mobility. Instead we cling to a false caution while the future is built elsewhere.

The truth is simple. The future is shaped by those who invest in it. Unless we change course, Britain will remain the clever country that never cashes in.

🎙️ On the latest Digital Forge Podcast, I asked Adam Pollock why UK pension funds will not back homegrown companies. His answer was clear: we do not grow our firms because the investment ecosystem forces entrepreneurs to sell too early. He also offered a fix. It is the conversation Britain needs if we are serious about building world-class giants here at home.

San Francisco: A City That Refuses to Stay Down

My weekly column in the Yorkshire Post

In 2018 an app called Snapcrap launched in San Francisco. Its purpose was to let residents photograph human waste on pavements so the city could send cleaners. Nothing symbolised the decline of a once great city more clearly.

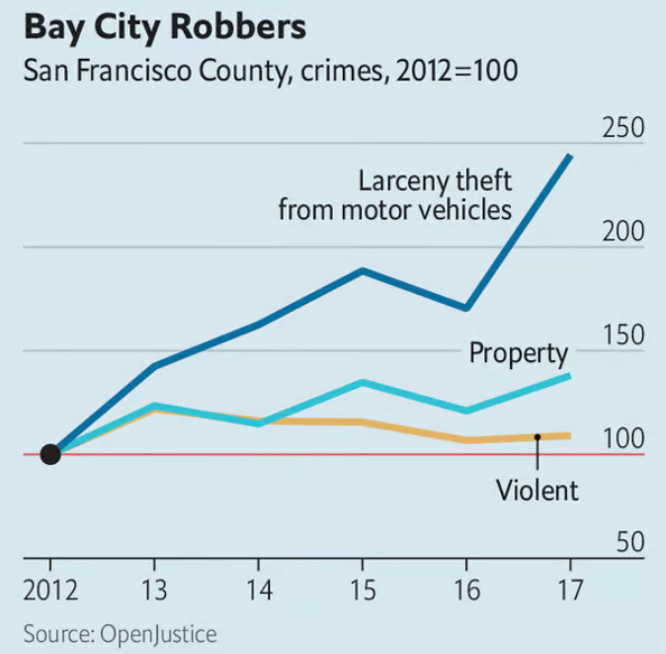

2020 San Francisco was in freefall. Homeless encampments stretched across streets. Fentanyl destroyed lives in plain view. Shops boarded up as theft soared. Car rental clerks warned me not to leave so much as a coat on the back seat, such was the scale of break-ins. For a city that had once embodied optimism and progress it was sobering.

But decline is not destiny.

I had seen something similar in New York in the 1990s. Times Square was a place to avoid after dark, filled with crime and vice. Today it is unrecognisable. The lesson is that cities can recover if leadership and investment align.

San Francisco has extraordinary resources. It is home to some of the richest companies on earth, world-class universities and a pool of talent unmatched anywhere. And the data now shows progress. Violent crime fell nearly a fifth in the first half of this year. Property crime dropped by a quarter. Homicides are down. Civic leaders are acting against fentanyl with shelters, treatment and enforcement. Housing reforms are moving forward .

California is the world’s fourth-largest economy. San Francisco matters too much to fail. The problems are still visible but they are no longer being ignored. The early signs of recovery are faint but real.

Cities can reinvent themselves. San Francisco has done it before and it will do so again.

Read My Column In The Yorkshire Post

Who Said Starting a Business is Expensive?

For most of history, starting a company meant raising capital, hiring teams of engineers, designers and marketers, and spending months building infrastructure before you could even test an idea. Today that world is gone. AI has rewritten the rules.

What once cost millions can now be done by a single founder with a laptop. The new entrepreneur’s toolkit is almost entirely free.

The Modern Founder’s Toolkit

🤖 ChatGPT — for coding, content, brainstorming and customer support. You can now write production-ready code, draft marketing campaigns or stress-test a business idea in minutes.

📝 Notion — a central hub for knowledge, tasks and collaboration. Replaces expensive project management software.

🛒 Gumroad — lets you sell digital products instantly, from e-books to software to templates.

🎨 Canva — professional-level design in minutes. Logos, pitch decks, ads, social content — no design team needed.

📢 Substack — publish, grow an audience and even build a paying customer base with zero upfront cost.

But this is only the beginning. The range of tools now available would have been unimaginable a decade ago.

🔍 Perplexity AI — a research assistant that can pull and synthesise information from across the web.

🎙️ Descript — turns podcast and video editing into a simple word processor. Delete a sentence in text and it vanishes from the audio.

🎬 Runway ML — video editing powered by AI, letting you generate scenes, change backgrounds, or even create entirely new footage.

💳 Stripe Atlas (US Only) — incorporates your company, sets up a bank account and payment system within days.

📊 Carta (US &UK)— the gold standard for managing ownership. Tracks your cap table, manages employee share options and keeps investors updated. It can also handle EMI schemes and UK compliance.

👩💻 Replit — lets you build and deploy apps in the browser, with AI coding support built in.

🖼️ Midjourney or DALL·E — generate brand assets, product mock-ups or even advertising visuals on demand.

📊 Airtable or Coda — powerful data tools for managing operations and workflows without hiring a developer.

📞 Zoom AI Companion — meeting transcription, action items and summaries, turning conversations into instant documentation.

Why This Matters

Twenty years ago cloud computing democratised access to storage and processing power. AI is now democratising talent.

A single founder can now:

Write an app with Replit and ChatGPT.

Create a logo and brand with Canva or Midjourney.

Record and edit a product video with Runway and Descript.

Sell it through Gumroad or Stripe.

Publish thought leadership on Substack.

All for little or no cost.

The implications are profound. Geography matters less. Networks matter less. Gatekeepers matter less. What matters is the idea and the discipline to execute it.

Even high-level strategy is accessible. A founder can build a virtual advisory board, with AI simulating the views of leaders like Musk, Bezos, Sandberg or Christensen, and use those debates to stress-test decisions before ever speaking to an investor.

Of course, AI cannot raise capital or build culture. But it has removed the first and hardest barrier to entry. The result will be an explosion of experimentation. Many ventures will fail, but some will succeed spectacularly. And because the costs are so low, the failures will not be fatal.

This is the democratisation of entrepreneurship. The cost of building has collapsed. The knowledge is open. The tools are in everyone’s hands. The question is no longer whether you can build a company. The question is whether you will.

🚀 Final Thought

This week’s stories share a single thread: Britain cannot afford timidity.

In Manchester I argued that pension fund caution is not prudence but negligence. PsiQuantum is a case study in how British taxpayers fund the breakthroughs while American investors take the rewards. Unless we change, we will keep paying twice and gaining nothing.

San Francisco shows that decline can be reversed. Leadership and will can turn even the bleakest situation around. If a city can recover, so can a country.

And AI shows us that barriers once thought insurmountable can fall overnight. The tools of entrepreneurship are now in everyone’s hands. The question is not whether we can build but whether we will.

🎙️ This is why on the latest Digital Forge Podcast I asked Adam Pollock what needs to change. His answer was clear: Britain does not have large tech companies because we do not grow them. Entrepreneurs are forced to sell too early because the ecosystem is not built to back scale. He also offered a fix. It is the debate we need to have if we are serious about building world-class companies here at home.

Capital, recovery, democratisation. These are the choices. If we act with courage, Britain can lead. If we shrink from risk, we will invent for others while wondering why the rewards pass us by.

Until next Sunday,

David

David Richards MBE is a technology entrepreneur, educator, and commentator. The Sunday Signal offers weekly insights at the intersection of technology, society, and human potential.

© 2025 David Richards. All rights reserved.