Sunday Signal: The Currency of Trust: How Power Really Moves in the Modern Economy

Exploring ideas at the intersection of technology, society, and human potential Issue #6 25 May 2025

⏱️ 5 min read

Welcome to The Sunday Signal — a weekly look at how technology shapes our world and what that means for all of us.

This week, I’ve been thinking about how power really moves—not through official channels or formal processes, but through something far older and harder to measure: trust.

Whether it’s Elon Musk raising billions by text, football clubs turning wages into wins, or capital flowing along familiar postcodes, a pattern emerges. The real economy doesn’t run on spreadsheets—it runs on relationships.

Also inside: why the illusion of meritocracy in sport is wearing thin, and what the latest venture data says about who gets backed—and who doesn’t.

🧭 The Currency of Trust: How Power Really Moves in the Modern Economy

In a world obsessed with data, we’ve constructed systems that claim to reward merit through objectivity. But beneath the spreadsheets and algorithms lies a deeper truth: the biggest decisions—investment, innovation, influence—still run on trust.

Whether it’s a billion-dollar business deal, a football league table, or the flow of venture capital, relationships remain the invisible architecture of power. This week’s Signal explores how these trust networks shape who gets funded, who wins, and who’s left waiting on the sidelines.

📱 Trust Over Term Sheets: How Elon Musk Raised £1.6 Billion by Text

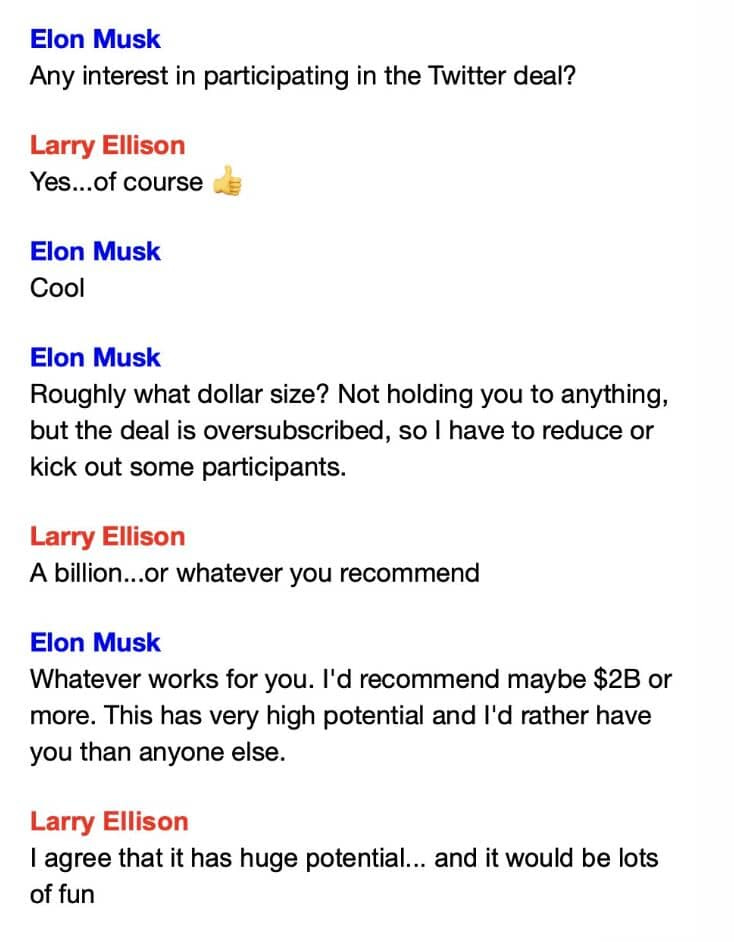

When Elon Musk needed to raise capital for his $44 billion acquisition of Twitter, the world expected pitch decks, diligence calls, and data rooms. Instead, Musk texted Oracle co-founder Larry Ellison.

Here’s the actual exchange:

Result: $2 billion (approx. £1.6 billion) committed—via text—in minutes.

The Architecture of Relationship Capital

This wasn’t about spreadsheets or forecasts. Ellison’s commitment was built on years of trust, shared beliefs, and admiration for Musk’s execution.

The lesson? In high-stakes business, the most important pitch isn’t delivered in a boardroom—it’s the one you’ve already given through years of character, consistency, and competence.

For founders and leaders alike, this is a reminder that relationships are not soft skills—they’re hard currency.

⚽ The Predictability of Football and the Illusion of Competition

Adapted from my latest Yorkshire Post column – Read full version →

This season’s Championship table mirrored financial muscle almost exactly:

Leeds United (£36.79m wage bill) – 1st

Burnley (£29.51m) – 2nd

Sheffield United (£27.17m) – 3rd

Portsmouth (£8.57m) – near the bottom

Parachute payments, meant to cushion relegation, now act as jet fuel, creating a financial aristocracy where wealth equals wins.

Even anomalies, like Cardiff City’s poor finish despite a top-tier wage budget, don’t prove unpredictability. They reveal execution failure in a system that expects proportionate results from financial input.

The FA Cup, once the stage for underdog magic, now feels like an afterthought. Meritocracy is still the brand, but capital is the operating system.

The Bigger Picture

When input (spending) and output (league position) align with near-mathematical certainty, we’re no longer watching competition—we’re watching a financial hierarchy played out on the pitch.

💷 The Geography of Capital: Why Innovation Still Has a Postcode Problem

Insights from the BVCA Venture Capital in the UK Report 2025

Despite billions in public and private funding, venture capital in Britain remains heavily centralised:

£9 billion deployed in 2024

51% of VC-backed businesses outside London (encouraging on the surface)

But 55% of employment still concentrated in the capital

And just 1.8% of funding went to all-female founder teams (down from 2.5%)

The Geography of Trust Networks

This isn’t just a London problem—it’s a network problem.

Venture capitalists operate in uncertain markets, so they rely on what feels certain: relationships, referrals, familiar institutions. Trust becomes the filter, and it’s usually built close to home.

That’s why talent remains evenly distributed, but opportunity doesn’t.

Arbitrage for the Bold

For those willing to build new trust networks—beyond traditional geographies, genders, and institutions—there’s a structural arbitrage waiting to be unlocked.

At Yorkshire AI Labs, we’re actively pursuing that edge. Not by waiting for capital to trickle up north, but by rewiring how discovery and evaluation happen—finding and backing exceptional founders far outside the usual postcode lottery.

🔄 Quick Hits: Trust Networks in the Wild

This dynamic appears across sectors:

🏦 Finance: Elite firms hire disproportionately from a handful of universities.

🎓 Academia: Peer review often favours insiders over fresh ideas.

🏛️ Government: The “Westminster bubble” runs on referral, not reach.

💼 Boardrooms: Most appointments come from existing director networks.

These aren’t flaws—they’re human systems optimising for familiarity, risk mitigation, and coherence. But they come at a cost: lost potential.

🔬 Designing Systems That Expand, Not Entrench

To change outcomes, we must change the shape of our trust networks.

For Entrepreneurs: Your reputation is your runway. It compounds faster than capital and outlasts any pitch deck.

For Investors: Beware the comfort of pattern recognition. The boldest opportunities live where your networks don’t.

For System Designers: Meritocracy isn’t a process—it’s an architecture. Broaden the base, and the results will follow.

For Leaders: Your power lies not just in your access, but in your ability to extend that access to others.

💭 This Week’s Question

Who do you currently trust based on relationships rather than formal credentials? Now ask yourself: who might deserve that same trust, but hasn’t had the chance to earn it—yet?

🚀 Final Thought

In a world of dashboards and KPIs, trust remains the most powerful—and underappreciated—asset in the modern economy. It flows through hidden networks, compounds through character, and determines outcomes long before any official decision is made.

The question isn’t whether trust networks shape the world—they do. The question is: will you consciously expand yours, or just inherit someone else’s?

Until next Sunday,

David

David Richards MBE is a technology entrepreneur, educator, and commentator. The Sunday Signal offers weekly insights at the intersection of technology, society, and human potential.

© 2025 David Richards. All rights reserved.